Best Gold IRA Business for Secure Retired Life Investments

Gold IRAs are popular retirement savings vehicles. The account user may buy gold, silver, platinum, and palladium with a gold individual retirement account.

A gold individual retirement account may diversify a portfolio, hedge against growing cost of living, and provide tax advantages.

Among the very best gold IRA companies is American Bullion. American Bullion is a leader in gold individual retirement account investments, using a vast array of services to aid investors establish as well as keep their accounts.

Investing in a gold IRA is a wonderful method to expand your portfolio and also hedge versus rising cost of living. American Bullion can help you set up and maintain your account, as well as their gold IRA rollover program makes it very easy to purchase gold.

Business Credibility As Well As Legitimacy

When it concerns buying gold, it is very important to find the most effective gold IRA business to ensure a safe and secure and successful investment. Gold can diversify your portfolio and protect your assets from inflation.

Nevertheless, it is very important to research study and also compare various gold individual retirement account companies to discover the one that ideal suits your needs. When investigating gold individual retirement account companies, try to find ones that are trustworthy and have a good performance history.

It is likewise crucial to think about the business’s customer support, costs, and also the types of gold that they use. Furthermore, some gold IRA business supply extra services such as storage space and also insurance coverage.

Experience, pricing, and customer service are crucial when choosing the finest gold IRA providers. Doing your study and contrasting different companies will assist you discover the most effective gold individual retirement account firms that can assist you accomplish your financial goals.

What Is A Gold individual retirement account?

Gold IRAs enable investors to store actual gold, silver, platinum, and palladium. Gold IRAs may diversify your retirement portfolio and protect your assets from inflation.

When it comes to gold individual retirement account business evaluations, it is very important to do your research. Make sure to seek gold IRA firms that have a good performance history as well as have been in business for several years. Make sure they are licensed and also insured, and that they offer competitive charges as well as compensations.

Furthermore, read testimonials from other customers to get an understanding of their customer support and also client complete satisfaction. With the ideal gold individual retirement account company, you can feel confident that your retirement financial savings are secure as well as will remain to expand with time.

How We Ranked The Leading Gold Investment Companies

Assembling a list of the most effective gold IRA companies was a difficult task. The process called for substantial research study right into the solutions supplied by gold IRA firms, the costs associated with each business, and also gold IRA firms evaluations.

After assessing every one of the information, the leading gold IRA firms were identified. The gold IRA business that made the listing have a lengthy background of providing superb customer support, competitive costs, as well as a large choice of gold as well as various other rare-earth elements.

They likewise have a proven record of risk-free as well as safe storage of gold as well as other precious metals. These gold IRA business have actually been thoroughly vetted and also racked up to make sure that they fulfill the highest possible criteria.

A gold individual retirement account provider should be reputable, have a good track record, and have low costs. With the ideal gold individual retirement account company, customers can be certain that their financial investments are protected which their gold and other precious metals will certainly be safe.

Searching for A Broker Or Custodian For Your Gold Based IRA

When it comes to purchasing gold, many investors prefer to utilize a gold-based individual retirement account A gold individual retirement account allows capitalists to take advantage of the stability of gold while likewise enjoying the possibility for resources recognition.

However, it is very important to locate a reliable broker or custodian to hold the gold in the IRA. This is where gold individual retirement account reviews can be practical.

Gold IRA assesses offer financiers with an introduction of the solutions supplied by various brokers as well as custodians. They can assist capitalists compare the costs, services, and functions of each option.

Additionally, gold IRA testimonials can give an overview of the overall consumer experience. This can be practical in identifying which broker or custodian is ideal fit for a financier’s requirements.

When searching for gold individual retirement account reviews, it is necessary to seek testimonials from reliable sources. These resources ought to give thorough and objective evaluations of the different brokers and custodians.

In addition, it is very important to seek reviews that are current as well as consist of info regarding any type of adjustments in charges or solutions.

Financiers should also think about the customer support supplied by the broker or custodian. Gold individual retirement account assesses can offer understanding into just how responsive the customer care group is and just how useful they are when it concerns addressing questions.

Finally, investors should also think about the costs connected with the gold IRA. Gold individual retirement account assesses can offer an overview of the fees related to each broker or custodian. This can assist investors determine which alternative is most cost-effective for their demands.

In general, gold IRA evaluations can supply financiers with a summary of the various brokers and custodians readily available.

They can help capitalists compare charges, services, as well as functions, as well as give insight right into the customer service experience. By researching gold IRA evaluations, financiers can locate the very best broker or custodian for their gold-based IRA.

Kinds of Gold You Can Hold In A Valuable Metals Individual Retirement Account.

Purchasing a gold IRA is an increasingly prominent method to expand retirement portfolios and secure against market volatility. Gold IRAs enable financiers to possess physical gold, silver, platinum, as well as palladium, as well as other rare-earth elements.

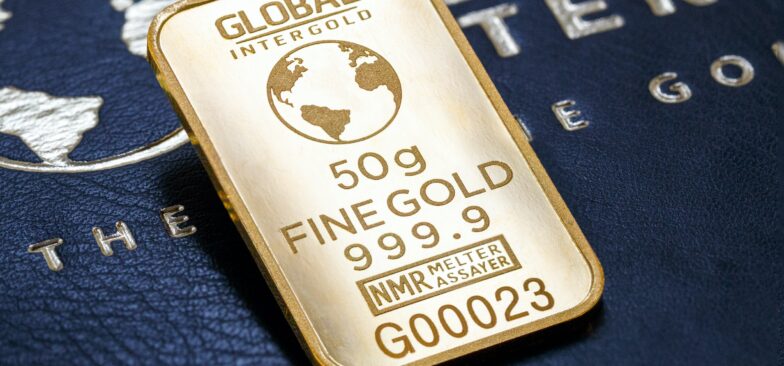

Gold individual retirement account evaluates can aid investors choose which sorts of gold are best for their retired life portfolio. Gold IRAs generally hold gold coins, gold bars, and also other kinds of gold bullion such as American Eagle coins, Canadian Maple Leaf coins, as well as South African Krugerrand coins.

Gold bullion is a preferred choice for gold IRA financial investments due to the fact that it is a substantial possession as well as its worth is not subject to the fluctuating securities market. Gold coins, on the other hand, are normally minted by the federal government as well as are considered legal tender.

Gold coins may be invested in gold individual retirement accounts and can boost a retirement profile. Gold IRA business reviews can help investors choose which sort of gold is best for their retirement requirements.

Reasons To Invest In Gold For Retirement

Purchasing gold for retirement is a smart move for those seeking to diversify their portfolios as well as protect their riches. Gold has actually long been a reputable property for those looking for to secure their financial future, supplying a variety of distinct benefits for retirement savings.

Right here are some of the crucial advantages of investing in a gold IRA:

- Reduced Volatility: Gold is less unstable than various other investments, suggesting it is much less likely to experience remarkable modifications in worth. This makes it an exceptional option for retired life cost savings.

- Tax Benefits: Gold IRAs are exempt from resources gains taxes, implying you can keep more of your retired life financial savings.

- Protection Versus Inflation: Gold can aid secure your retired life savings versus rising cost of living, as its worth often tends to raise when the price of living rises.

- Diversification: Buying gold can assist expand your retired life profile, lowering your risk and also protecting your financial savings.

- Long-Term Financial Investment: Gold is a long-term investment, implying it can provide a stable stream of earnings for your retirement years.

Gold IRAs supply low volatility, tax benefits, defense against inflation, diversification, and long-lasting financial investment capacity, making them a perfect option for retired life savings.

Buying gold for retirement is a smart move for those seeking to expand their portfolios and also safeguard their wealth.